Invest with a Self Directed Gold IRA

Key Points

- A Gold IRA is a type of Self Directed IRA that you can use to invest in gold or other precious metals.

- There are many benefits of investing in gold including that it’s a hedge against inflation, it has consistently held value throughout history, and that it’s a great portfolio diversifier.

- It’s important to note that there are minimum fineness requirements and specific metals that you are able to invest in with a Self Directed Gold IRA.

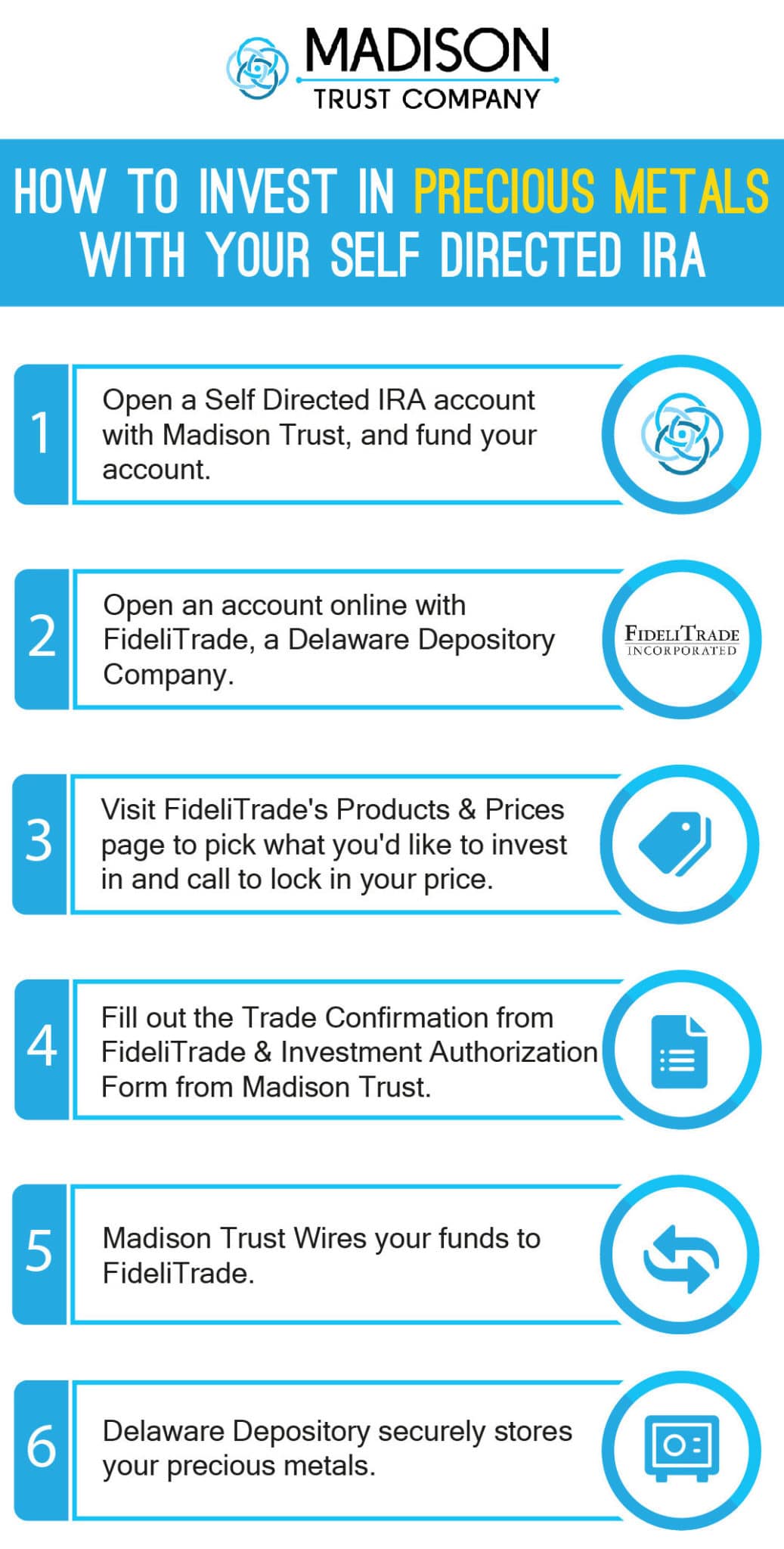

- You can set up a Self Directed Gold IRA with Madison Trust in six simple and secure steps.

Are you looking to invest in something tangible, like Gold, Silver, or other precious metals? Madison Trust’s Self Directed Gold IRA gives you the freedom to do just that!

What is a Gold IRA?

A “Gold IRA” (sometimes also called a Precious Metals IRA) is a type of Self Directed IRA, or Individual Retirement Account, that you can use to invest your retirement funds. While you would receive the same tax-advantages as a standard IRA, the big difference is what you can invest in. With a standard IRA, you can invest in stocks, bonds, and mutual funds. With a Self Directed Gold IRA, you can expand beyond the traditional Wall Street assets and invest in gold or other precious metals.

Why should I invest in Gold?

If you’re wondering why you should invest in gold, look no further. There are several benefits to holding Gold in your IRA:

Hedge Against Inflation

Throughout history, when the dollar’s buying power decreases, gold’s value tends to increase in response. This is why many investors flock to gold during periods of inflation.

Value Throughout History

Taking a look back in time, gold has historically kept its value. In addition, many see gold as a way they can pass on their family wealth to the next generation.

Diversify, Diversify, Diversify!

Gold can be an excellent asset to invest in to diversify your retirement portfolio because it increases in value when stocks’ and bonds’ value falls and vice versa.

What Types of Precious Metals Can I Invest in?

With Madison’s Self Directed Gold IRA, you can invest in several types of metals, including Gold, Silver, Platinum, and Palladium. It’s important to note that each of these metals has certain fineness requirements as per the Internal Revenue Code:

- Gold: 99.5% pure

- Silver: 99.9% pure

- Platinum: 99.95% pure

- Palladium: 99.95% pure

It’s important to note that if your precious metals investment is minted by the government (e.g. American Eagle coins), it does not need to meet the fineness requirements mentioned above.

If your precious metals are not government-issued, then they need to be accredited and meet the fineness requirements.

How do I Invest in Precious Metals with a Self Directed Gold IRA?

Now that you know what types of metals you can invest in, you may be wondering how to get the ball rolling on your investment.

Madison Trust works directly with FideliTrade and Delaware Depository on all Gold IRA trades to ensure that you are getting a fair price, and that you can have peace of mind knowing your metals are securely stored in Delaware Depository’s vault.

You can invest in gold or other precious metals with Madison’s secure and simple six-step process:

Take this info on the go!

Download a PDF version of our Self Directed Gold IRA Investment Process for your future reference.

Why Madison Trust?

Step-by-Step Guidance

If you’re unsure where to get started with investing in gold, a knowledgeable member of our team you through the process step-by-step from opening your account to placing your investment.

Secure Investing

As stated in our process, Madison Trust works with FideliTrade and Delaware Depository for all gold investments. We want to ensure that our clients have the best investing experience as possible.

Straightforward Fees

As your investments grow, your fees will stay the same. Amongst the lowest in the industry, our flat rates help ensure you will never pay more for investing in your future.

It’s time to give your retirement funds the golden opportunity to grow with Madison’s Self Directed Gold IRA!

If you’d like to get the investing process started or have more questions, our dedicated client support team is here to help.