5 Self Directed IRA Rules

Self Directed IRAs allow individuals to invest their retirement funds into alternative assets such as real estate, private placements, LLCs, promissory notes, and tax liens. While standard IRAs generally only accommodate traditional investments (such as stocks, bonds, and mutual funds), Self Directed IRAs provide investors with the opportunity to balance their IRA portfolios with tangible assets. The benefits of a Self Directed IRA are manifold, including IRA portfolio diversification and strong growth potential associated with investments featuring a high risk / high reward ratio.

It is important to ensure all investments are in compliance with the Self Directed IRA rules. Although these rules do not apply to the most popular alternative investments, they are important to keep in mind to maintain the tax advantaged status of your Self Directed IRA.

1 – Avoid Prohibited Transactions

Congress enacted the Employee Retirement Income Security Act in 1974 with the intention of encouraging Americans to save for retirement via tax advantaged retirement accounts. Congress imposed “Prohibited Transaction” rules to ensure that individuals do not receive personal benefit from their retirement accounts before distribution. The following formula summarizes what constitutes a prohibited transaction:

Transaction between a “Retirement Plan Asset” and “Disqualified Person” = “Prohibited Transaction”

A Prohibited Transaction does not limit what an IRA can invest in, but who the IRA may transact with. An IRA may only transact with third parties, as opposed to immediate family members or closely held entities. For example, a Self Directed IRA may purchase a real estate property and lease it to a third party, however that same property cannot be leased to the IRA owner’s parent or child. In these scenarios the IRS would see the IRA as directly benefiting a disqualified person, which is a prohibited transaction.

If an IRA owner engages in a prohibited transaction, the entire IRA account is distributed, and the IRA owner is subject to taxes and penalties on the distributed amount.

To learn more about who is a disqualified person, what is a prohibited transaction, and common examples and consequences of prohibited transactions, please read the following article: Prohibited Transactions.

2 – Perform Due Diligence

It is recommended that investors perform their own due diligence before placing an alternative investment. Most private placements are not required to register with the SEC because their investors are considered “accredited”. This lack of registration can present additional risk, making proper due diligence very important. Investors should also review the proposed investment with a financial professional to determine whether it is appropriate for their personal financial situation.

3 – Acquire Financing If Needed

Many investors are surprised to learn that IRAs may obtain financing for investments. When financing an investment, it is important to keep the following Self Directed IRA rules in mind:

- Non-Recourse- Loans issued to an IRA must be non-recourse. Non-recourse loans are backed by investment collateral, and not by a Borrower’s personal guarantee. In case of default, the lender can only collect the collateral and may not pursue the Borrower’s personal assets. If one were to personally guarantee a loan issued to their IRA, then they would be providing a benefit to their retirement account (which is violating the Prohibited Transaction rule). Non-recourse financing provides investors with the capital they need for IRA investments, while avoiding prohibited transaction scenarios.

- Non-Disqualified Persons- Loans issued to an IRA must be from a third-party, not from a Disqualified Person.

- UDFI- When an IRA uses leverage for an investment, then the earnings attributed to the financed portion are subject to UDFI (Unrelated Debt Financed Income). Your accountant or tax preparer will determine whether such taxes are owed and will report this income to the IRS on Form 990-T if applicable.

4 – Consider IRA LLC transactions:

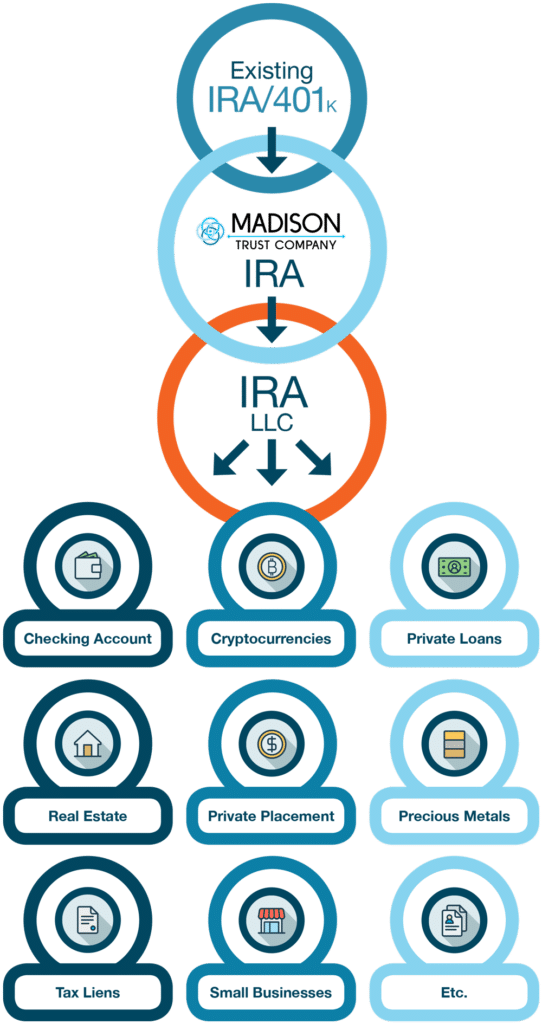

IRA LLCs allow investors to perform time-sensitive and transaction heavy investments under the umbrella of a Self Directed IRA. One thing to keep in mind is that investment transactions can be performed directly within the IRA LLC, while IRS reportable transactions need to flow through an IRA custodian. For example, Managers of an IRA LLC can place investments, pay investment expenses, and deposit investment income using their LLC checking account. However, IRA contributions, distributions, rollovers, etc. must pass through an IRA custodian so that they are reported to the IRS.

5 – Pay Taxes, If Applicable

While the profits gained from most IRA investments are not subject to tax, if an IRA earns “active income” the profits are subject to Unrelated Business Income Tax (UBIT). This tax does not apply to most IRA investments as they either earn dividend income, rental income, interest income, royalty income, or capital gains. Some common investments where UBIT does apply is short term flips, real estate development, or active businesses (e.g. a franchise, convenience store, or gas station). When reviewing your IRA investments, your accountant or tax preparer will determine whether UBIT is due and will prepare Form 990-T, if applicable.

It is important to understand and comply with the above rules to avoid adverse tax consequences and penalties. Reach out to an IRA Account Specialist to learn more about Self Directed IRA rules and the investment process.